Mokhoa oa ho bala mosebetsi oa Australia le GST ha o reka kantle ho China ho ea Australia?

Mosebetsi / GST ea Australia e lefuoa ho meetlo ea AU kapa mmuso o tla fana ka invoice ka mor'a hore u fane ka tumello ea meetlo ea Australia.

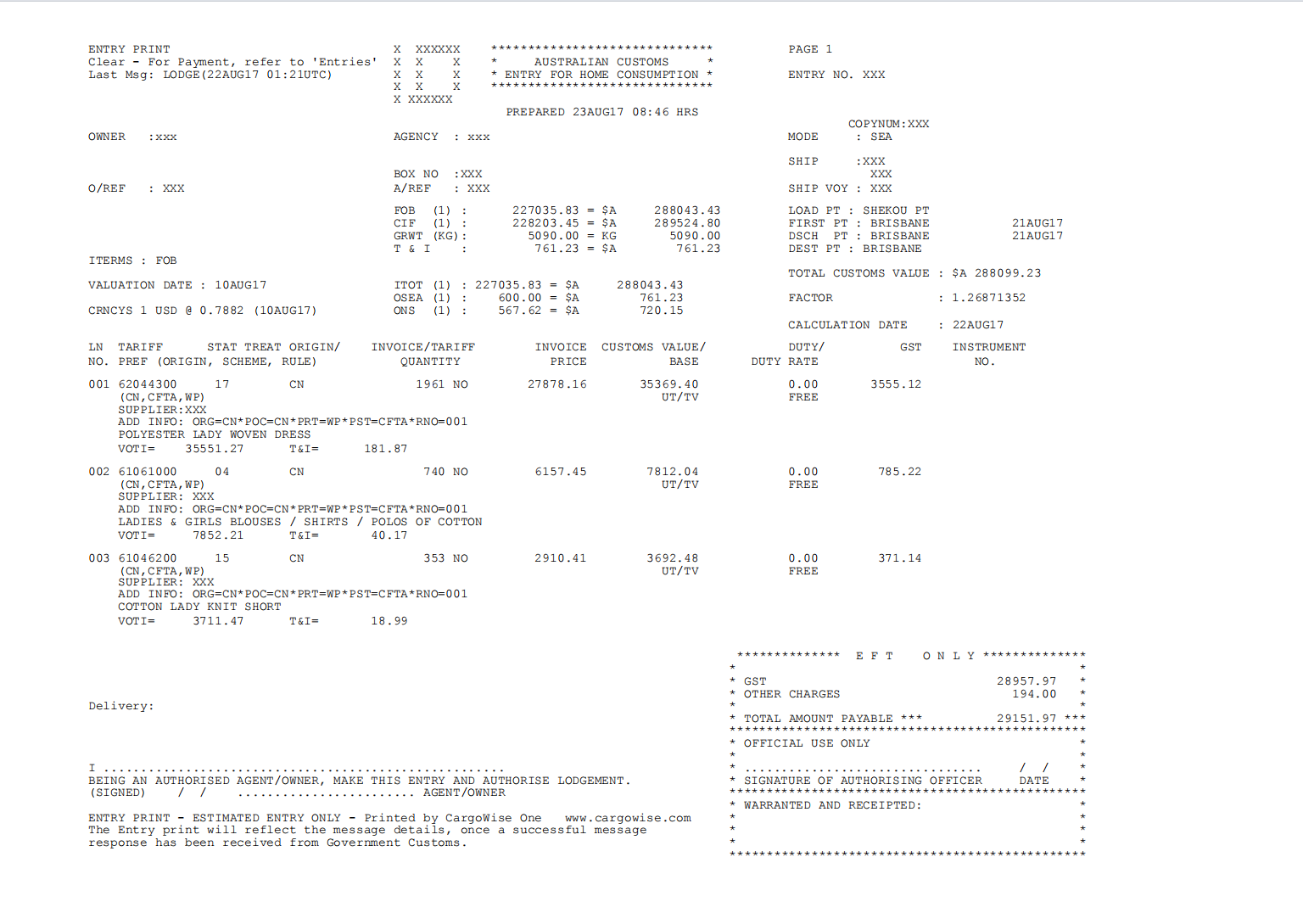

Invoice ea Australian duty/GST e na le likarolo tse tharo tseo e leng DUTY, GST le ENTRY CHARGE.

1.Duty e itšetlehile ka mofuta oa lihlahisoa.

Empa joalo ka ha China e saenetse tumellano ea khoebo ea mahala le Australia, haeba o ka fana ka setifikeiti sa FTA, lihlahisoa tse fetang 90% tse tsoang China ha li lefelloe.Setifikeiti sa FTA se boetse se bitsoa setifikeiti sa COO mme se sebelisetsoa ho bonts'a hore lihlahisoa li entsoe China.

2.GST ke karolo ea bobeli eo u lokelang ho e lefa ho meetlo ea AU ha u reka kantle ho naha ho tsoa Chaena.

GST ke 10% ea boleng ba thepa eo ho leng bonolo ho e utloisisa

3. Tefiso ea ho kena ke karolo ea boraro eo meetlo ea AU e tla e lefisa 'me e boetse e bitsoa litefiso tse ling.E amana le boleng ba thepa boo hangata bo tlohang ho AUD50 ho isa ho AUD300.

Ka tlase ke mohlala oa invoice ea Australian duty/gst e fanoeng ke litloaelo tsa AU :

Leha ho le joalo, haeba boleng ba thepa ea hau bo le ka tlase ho AUD1000, u ka etsa kopo ea zero AU duty/gst.Meetlo ea Australia e ke ke ea fana ka invoice

For more information pls visit our website www.dakaintltransport.com or email us at robert_he@dakaintl.cn or telephone/wechat/whatsapp us at +86 15018521480

Nako ea poso: Oct-24-2023